The transformation of the insurance sector is rather swift. Consumers, particularly those in the present time, demand rapid service, straightforward replies, and just claim settlements as a right. They refuse to wait for weeks only to be informed about the situation of their claims. This situation is compelling insurers to re-evaluate their claim processing approaches.

Insurers relied on rule-based automation for several decades, in which the processing of claims was done strictly according to some predefined rules. It resulted in the decrease of manual tasks, but at the same time caused the emergence of many issues.

Grasping Rule-Based Automation In Insurance

Rule-based automation is based on fixed instructions. For example, a document with a missing field is rejected by the system. If the claim amount exceeds a predetermined limit, it is subject to manual review. These rules are laid down by humans and remain unchanged until someone modifies them.

Initially, this system appeared to be beneficial. It cut down on paperwork and time. But gradually, insurance companies began to experience serious problems. Rule-based systems cannot think. They cannot acquire knowledge.

Problems with Rule-Based Claims Processing

The main issue is a lack of flexibility. Each exception necessitates the creation of a new rule. This leads to a convoluted and sluggish system. When practices alter or new types of claims come into existence, rule amendments require time and finance.

A further problem is the extent of manual work involved. A situation where the claim is returned to human teams for processing is what happens when a rule-based system falls short. This causes delays and adds to the workload.

Due to these issues, the majority of insurers began to ponder the crucial question: Is there a better method?

What Is AI-Driven Claims Processing?

AI-driven claims processing relies on artificial intelligence, which can comprehend, alter, and grow with time. Unlike the old methods, AI decision-making relies on the identification of data patterns rather than imposing unyielding rules.

Reading papers, understanding the content, verifying pictures, and even learning from prior claims are some of the tasks AI can do. It does not require flawless data. It is capable of treating illegible scripts, ruined records, and a lack of data as well. This is why AI is now taking over traditional automated claim processing in insurance.

Why Insurance Leaders Are Choosing AI Over Rules

Insurance industry leaders set their sights on three areas: speed, precision, and customer satisfaction. AI comes through on all accounts. AI can process claims in a considerably shorter time than the rule-based systems. It can scrutinize thousands of claims at the same time, without experiencing fatigue.

Moreover, AI is also more precise. It takes advantage of the learning process provided by the mistakes and therefore gets better with each claim. The rule-based systems falsely repeat the same errors continuously.

AI vs Automation: Understanding the Real Difference

It is a common misconception that AI and automation are one and the same. Such is not the case. Automation does what it is programmed to do. AI recognizes and reacts to the environment.

In the battle of AI vs Automation, automation is just a number-crunching machine, while AI is like a creative and resourceful human assistant who helps and develops. Automation gets outdated regularly. AI becomes better and smarter.

How AI Improves Automated Claim Processing Insurance

AI substitutes manual operations in the middle of the claim’s journey. To begin with, the AI picks up information from the claim forms through the use of an intelligent OCR system. It can read the words even if the layout changes. The next stage is a check of the docs for mistakes, duplication, and signs of fraud by AI. In order to discover strange patterns, it is comparing the present claims with the data from the past. AI then takes the necessary steps to settle the dispute in a matter of seconds or to refer it to the human for review. Consequently, both the customers and the staff save time.

Better Fraud Detection with AI

One of the greatest challenges faced by the insurance industry is fraud. Traditional systems based on rules are only able to identify types of fraud that are already known. AI can reveal more hidden theft. One of the major techniques used by AI is the study of human behavior by looking at the patterns that are being traced over time. It monitors how claims are made, their frequency, and the circumstances under which they are made.

Thus, fraud loss is reduced, and truthful customers are protected. The insurance sector has recognized this as one of the most impressive features of the AI-driven claims processing.

Lower Costs and Higher ROI

The main reason behind the choice of AI by insurance leaders is savings in costs. The rule-based systems require regular and uninterrupted maintenance, which adds to the costs. AI is a way of relieving the pressure.

AI also cuts down the amount of manual labor done. There will be a few people involved in doing such repetitive work. The variable of employees will be that they will be dealing with complex cases and customer care instead of simple ones, and with less interest by being focused on them or vice versa.

Faster Claim Settlements and Happy Customers

Claim settlement is the most critical moment in the relationship between an insurance company and a customer. A long process will make people lose trust. AI is powering up systems that can settle all but the most complicated claims in just a few minutes; customers get the updates in real time; they feel respected and informed, as it were.

The brand image and customer loyalty were then boosted even more, because the insurance company leaders are aware that the happy customers who are already with their company will not only stay but also will tell others about it.

Easy Scalability for Growing Businesses

The volume of claims that insurance companies have to deal with grows along with their businesses. Rule-based systems are unable to cope with the increased demand.

On the other hand, AI systems can be scaled up with ease. AI can take care of the entire smooth process, no matter the volume, i.e., whether it’s 1,000 claims or a million claims.

This, basically, makes AI a solution suitable for both small and large enterprises alike. Growth is no longer feared but rather seen as an opportunity.

Compliance Made Simple with AI

Insurance is a heavily regulated sector. The frequent new rules require regular updates for the rule-based systems. However, the AI systems are fast at being trained on new regulations. They reduce compliance risks and are more flexible to change.

Thus, the insurance executives will be in a position to express their confidence in the legal aspect and, at the same time, run their businesses smoothly.

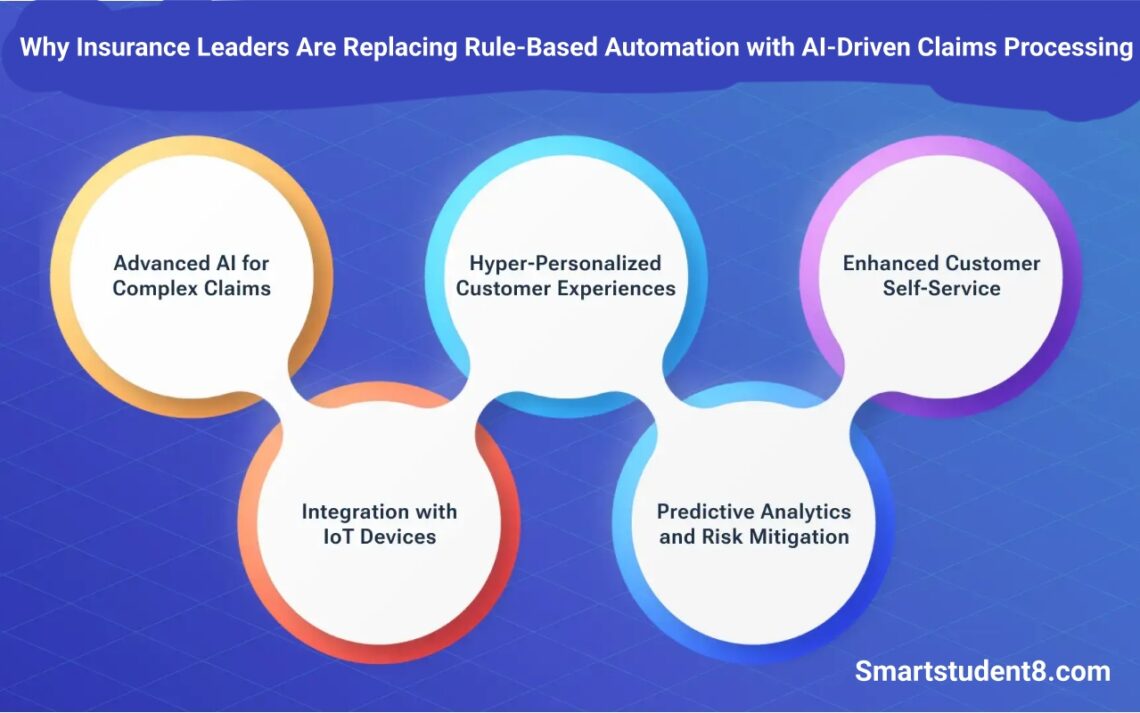

The Future of Insurance Claims Is AI-Driven

The transition from rule-based automation to AI is permanent, not just for the time being. It is the future. The insurance industry has come to realize that speed, accuracy, and fairness are the three main requirements of customers. And AI grants all of them.

When it comes to the comparison between AI and automation, AI unambiguously prevails with the offering of more value, more smarts, and better outcomes. The early adopters of AI technology will be the market leaders of tomorrow.

Conclusion

Claims are the core of the insurance business. Good claims processing creates trust, while poor claims defeat the purpose and eventually drive customers away. Rule-based automation was a great help in the past but cannot cope with today’s complexities. AI-based claims processing is smarter, faster, and more reliable. That is the reason why insurance leaders phase out old systems in favor of AI-based solutions for automated claim processing. The future is for those who prioritize smarts over strict rules. And that future is already here.